Evergrande Group Stock, Evergrande Related Stocks Plunge As Liquidity Crisis Deepens Global Times

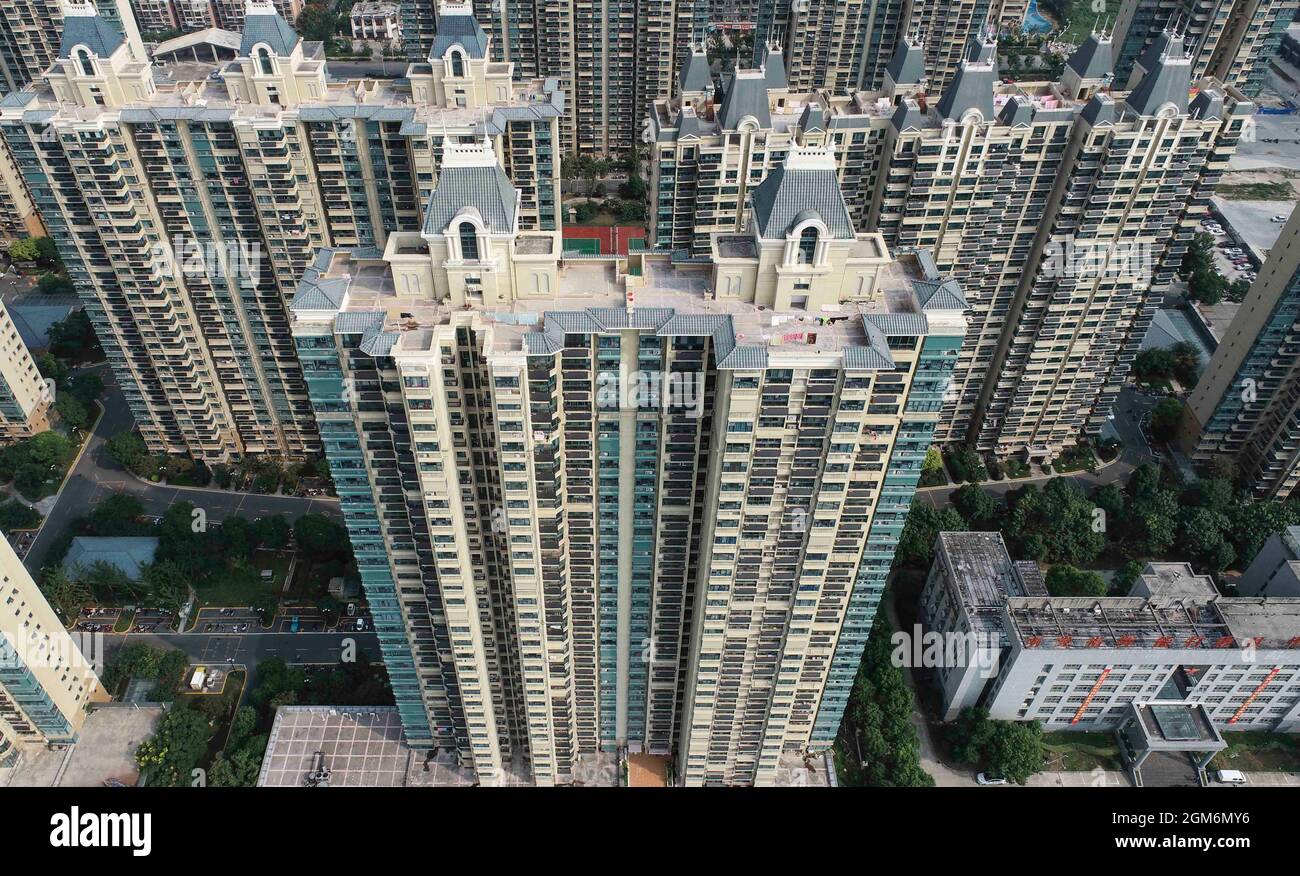

Formerly called the Hengda Group Evergrande was founded by Xu Jiayin in the southern Chinese city of Guangzhou in 1996. China Evergrande Group is an integrated residential property developer.

The stock has lost 21 so far this year.

Evergrande group stock. China Evergrandes top creditor has trimmed its loans to the nations most-indebted developer to assuage investors a sign lenders have started to raise their guard against default risks. China Evergrande Group placed 260 million shares or 266 of issued share capital of China Evergrande New Energy Vehicle Group Ltd for HK106 billi. Local time on Tuesday.

Chinese regulators have instructed major creditors of China Evergrande Group to conduct a fresh round of stress tests on their exposure to the worlds most. Citation neededIn October 2009 the company raised 722 million in an initial public offering on the Hong Kong Stock Exchange. The stock closed 9 up at HK1080.

And Aoyuan Healthy Life Group Co according to data compiled by Bloomberg. The stock is no longer Hong Kongs most shorted developer lagging behind the short interests in Country Garden Holdings Co. Shares of Hong Kong-listed Evergrande jumped as much as 88 to an almost two-week high in afternoon trade versus a gain of 01 gain in the.

China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020Bondholders are rushing for the exit too spooked. Earlier this month Evergrande said it was arranging payment for some of its project companies commercial paper that had not been repaid on time. One reason may be that Evergrande shares have already been falling having lost 60 since their recent peak in July.

The stock climbed 24 as of 1036 am. Up to 35 of the aggregate principal amount of the Notes with the Net Cash Proceeds of one or more sales of Common Stock of the Company in an Equity Offering at a redemption price of 1105 of the principal. Moodys Investors Service downgraded China Evergrande Groups credit rating by one notch to B2 as the debt-ridden property developer struggles to ease its debt crunch.

Latest Quotes as of 17 Sep 2021. Evergrande EV Stock Loses 80 Billion in Worlds Worst Rout Bloomberg -- Shares of China Evergrande Groups electric vehicle unit are collapsing in Hong Kong wiping about 80 billion from. Part of Sunings financial crunch can be traced to its 2017 investment of 20 billion yuan in a unit of China Evergrande Group the worlds most indebted property developer.

The property services group is 60 per cent-owned by developer China Evergrande group based on its latest annual report. Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday. In 2010 and invested heavily and under Marcello Lippi they won the 2013 AFC.

Evergrandes bonds have also tumbled. Bloomberg China Evergrande Group the countrys most indebted developer rose in Hong Kong trading after the company bought back HK336 million 43 million of shares. The group bought football club Guangzhou Evergrande FC.

Evergrande should receive around CNY25 billion by selling a 2999 stake in China Calxon Group Co Ltd a Hangzhou-based homebuilder listed on the Shenzhen stock exchange but we see this as immaterial compared with its debt. Resurgent concerns about the health of China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020. Chinas most indebted property developer Evergrande Group 3333HK plans to repay its 147 billion offshore bond maturing next Monday this week ahead of schedule a source close to Evergrande said.

The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value. Billionaire Zhang Jindongs 30-year old empire is facing a critical test as concern mounts over Suning Appliance Group Cos financial health and its links to China Evergrande Group. The downgrade reflects Evergrandes weakened funding access and reduced liquidity buffer given its large debt maturities in the coming 1218 months amid the tight credit environment in China and volatility in the.

It had 565 million square metres of. The mid price on the companys 134 billion June 2023 bond was last quoted at 80625 cents according to Refinitiv down from a recent peak of 9175 on May 26. Evergrande and its subsidiaries have outstanding bond s worth 28 1 billion according to Refinitiv data including the bond due on June 28.

Evergrande Fears Spread Sparking Hong Kong Selloff Barron S

Update Debt Ridden Evergrande S Stock Slides After Regulatory Talk Caixin Global

Evergrande Stock Traders Are Facing Increasing Liquidity Risk Bnn Bloomberg

Evergrande Shares Raise Over Three Billion Dollars Electrive Com

Evergrande Related Stocks Plunge As Liquidity Crisis Deepens Global Times